Automate the reminders process in collections

You can automate each step in the reminder processes. You can set up automated jobs to create, issue, and send (or print) reminders, and you can create custom email texts for each reminder level so your messages suit your business's collection policies and practices.

You set up reminder automation on the Reminder Automation page, where you create the individual automations. You can combine the steps to create, issue, and send reminders, or you can create separate automations for each step if that's better for your collections processes.

On the Reminder Automation page, you define the individual actions (steps) in the automations. You can set filters for reminder terms for the automation as a whole, and set additional filters for each action in the automation. You can also include outstanding invoices attached as PDFs to the emails.

After you set up and start an automation, it'll run until you put it on hold or stop it. If you want to control how the automation runs, you can open the Job Queue Entries page and set the recurrence to daily, or every Tuesday, for example.

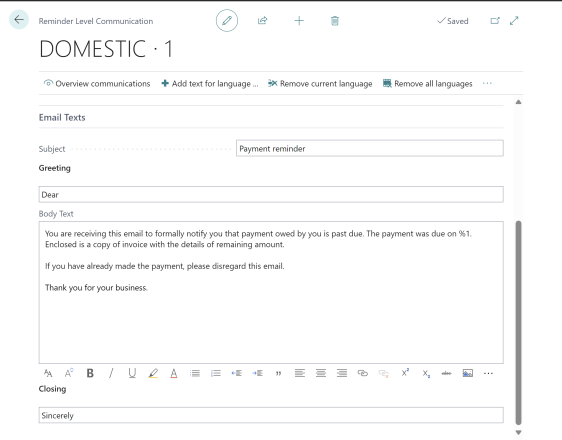

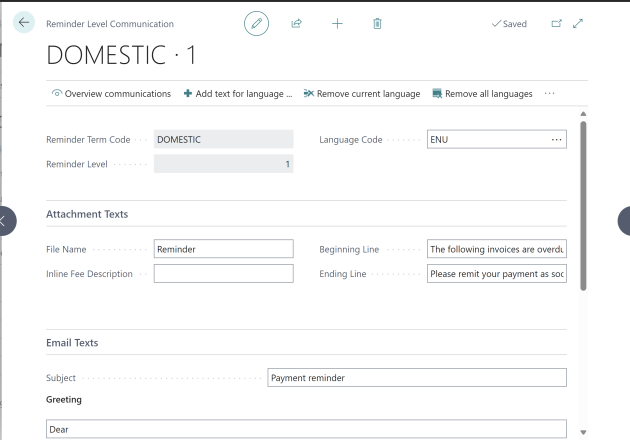

On the Reminder Level Communication page, you can enter texts to show on the reminder on the Attachment Text FastTab, and body texts for emails on the Email Text FastTab. The texts let you tailor messages for each reminder level, which makes it more flexible and accommodates business policies for communicating payment requests.

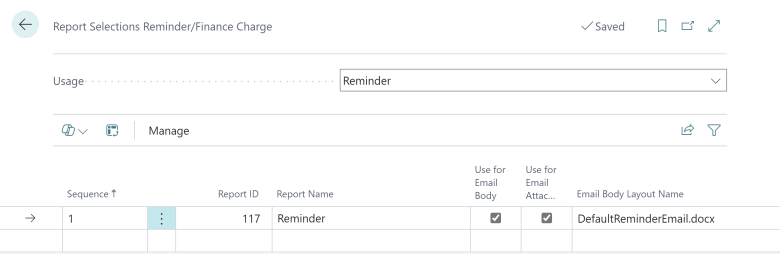

When you send an email, the reminder is a report you attach to the email. You define the report that generates the reminder on the Report Selection Reminder/Finance Charge page, where you also select the report that holds the email body text in the Email Body Layout Name field. When you send emails to your customers, the texts on the Email Text FastTab is inserted in the report selected in the Email Body Layout Name field. The standard report has different text fields to contain this field (GreetingText, BodyText, ClosingText). If you prefer, you can edit this report to have more content. The layout of these reports can be managed and edited in the (searchable) Report Layouts page if you need to tailor them to your business needs.

Related Articles

Managing Receivables

In this article See Also Start a free trial! A regular step in any financial rhythm is to reconcile bank accounts, which requires that you apply incoming payments to customer or vendor ledger entries to close sales invoices and purchase credit memos ...Send Reminders of Outstanding Balances

You can use reminders to remind customers about overdue amounts. You can also use reminders to calculate finance charges such as interest or fees and include them on the reminder. Before you can create reminders, you must set up reminder terms and ...Set Up Finance Charge Terms

When a customer does not pay by the due date, you can have finance charges calculated automatically and add them to the overdue amounts on the customer's account. You can inform customers of the added charges by sending finance charge memos. But ...Collect Outstanding Balances

In this article Statements Reminders Finance Charges Multiple Interest rates See Also Managing receivables includes checking whether amounts due are paid on time. If customers have overdue payments, you can begin by sending the Customer Statement ...Block Customers

In this article To block a customer See Also You can block a customer, for example because of insolvency, so that the customer cannot be added to sales documents or so that no transactions can be posted for the customer. In addition to blocking a ...